It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. Self-employment is the state of working for oneself rather than an employer.

Self Employed Health Insurance Deduction Healthinsurance Org

Gov Sg Covid 19 Resources

Adam Carter Social Media Marketing Specialist Self Employed Linkedin

If youre self-employed you can use the individual Health Insurance Marketplace to enroll in flexible high-quality health coverage that works well for people who run their own businesses.

Self employed 中文. Generally tax authorities will view a person as self-employed if the person chooses to be recognised as such or is generating income such that the person is required to file a tax return under legislation in the relevant jurisdiction. If youre a freelancer an entrepreneur a part-time worker or self-employed you have a few coverage options that work well for independent careers and lifestyles. If youre a self-employed earner WA Cares is your key to long-term care coverage.

Youre considered self-employed if you have a business that takes in income but doesnt have any employees. You can buy an insurance plan any time of year even if its outside Open Enrollment. Youll pay the current premium rate which is 058 percent of.

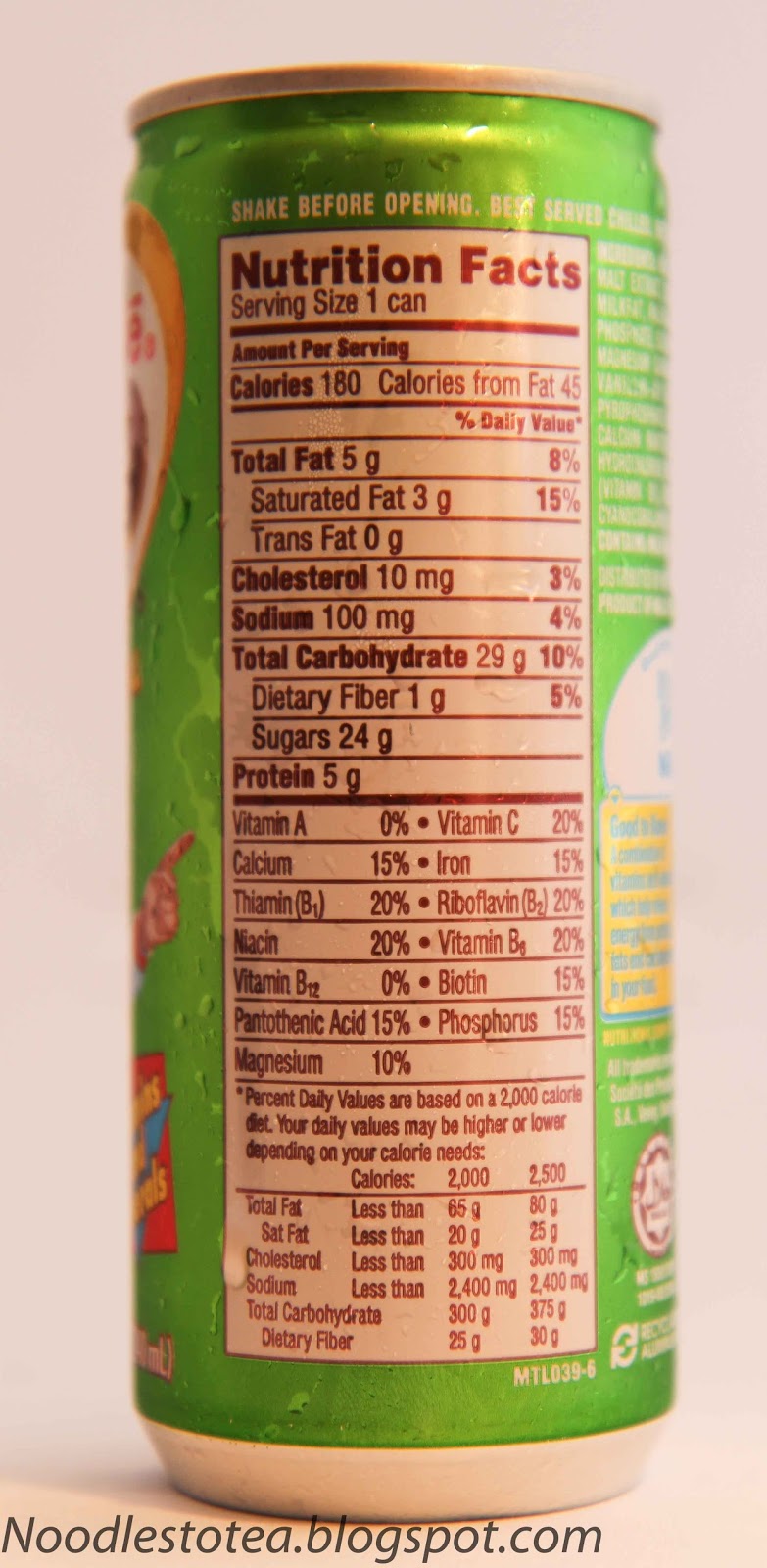

If you leave a job for any reason and lose job-based insurance. Your contribution is just as low as traditional workers. Self-employed individuals generally must pay self-employment tax SE tax as well as income tax.

To voluntarily opt in yourself you must submit a voluntary coverage form to the Workers Compensation Board and notify your insurance carrier of your intent to opt in to both Paid Family Leave and disability insurance. Access tax forms including Form Schedule C Form 941 publications eLearning resources and more for small businesses with assets under 10 million. Gross wages if any paid to you from your business entity.

If you are a self-employed individual who has employees in New York State eg a business owner you are already required to have coverage for your employees. Pandemic Unemployment Assistance was a federal program that was part of the Coronavirus Aid Relief and Economic Security CARES Act that provided extended eligibility for individuals who have traditionally been ineligible for Unemployment Insurance benefits eg self-employed workers independent contractors. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Gov Sg Covid 19 Resources

Self Employed Linkedin

Uber Drivers What Happened What S Next And What This Means For The Gig Economy

China Statistical Yearbook 2019

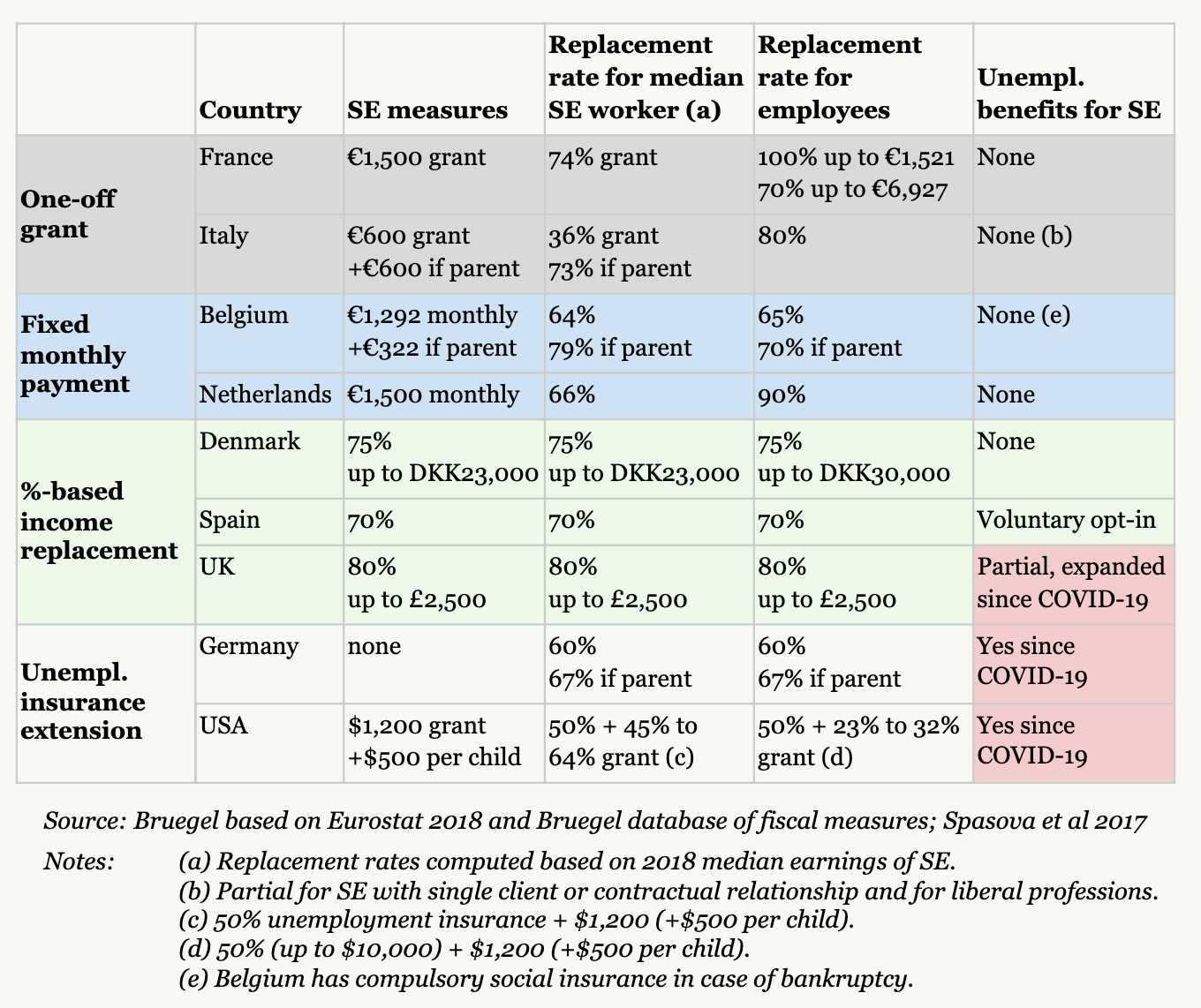

Covid 19 The Self Employed Are Hardest Hit And Least Supported Bruegel

Self Employed Individuals Paid Family Leave

Workfare Employee

.gif?sfvrsn=2e98bd6a_0)

Iras Applying For Certificate Of Residence Cor